CBSL likely to maintain the policy rates at the current level this week; a Sizeable rate cut likely in 2Q

1 min read

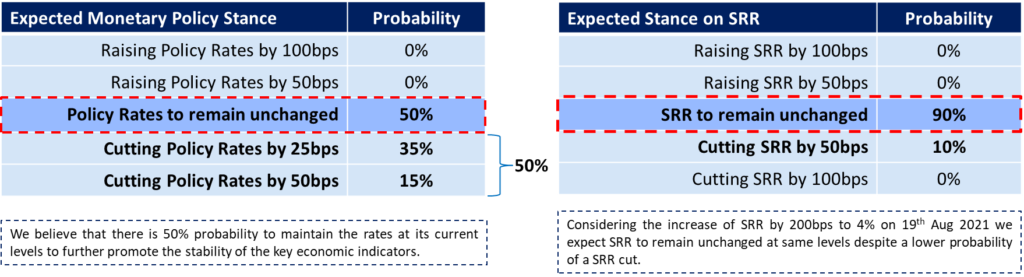

First Capital Research predicted a 50% possibility of the Monetary Board of the Central Bank of Sri Lanka (CBSL) maintaining the policy rates at the current levels.

“We believe that CBSL may consider maintaining the monetary policy rates at its current levels in the upcoming policy review meeting allowing a soft landing from its hawkish to dovish stance. However, considering both arguments for and against monetary easing, we have assigned an equal probability

for both scenarios. Accordingly, we have assigned 50% probability for a relaxation in the monetary policy to alleviate the overreacted interest rates in the tighter monetary environment. Meanwhile, the remaining 50% probability for rates to remain unchanged at the upcoming policy review,” it said.

However, FCR expects the economy to return to normalcy with the country being able to sign the IMF deal by Mar-23 and secure necessary financing from IMF and other multilateral creditors while regaining its access to the global capital market during the year. Thereby, with the complete stabilization of

economic indicators, we expect concentration would be shifted towards fast-tracking the revival of the economy giving rise to a sizable rate cut in2Q2023.