DFCC Virtual Wallet, the only Hybrid wallet in the Banking Industry launches ‘Digital Dansala’ to Empower COVID-stricken Local Communities

3 min read

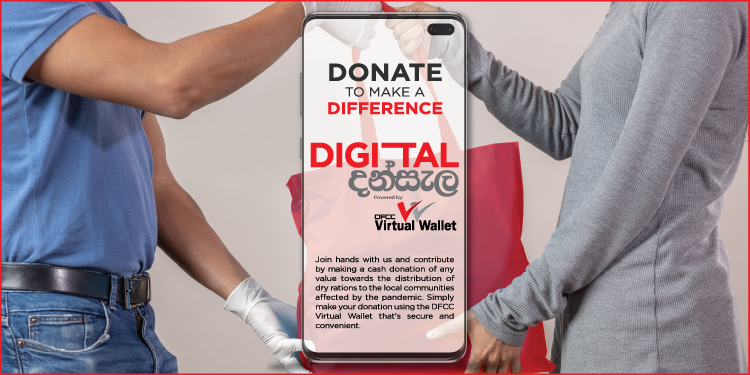

Sri Lanka’s DFCC Bank in its pursuit of becoming one of the most customer-centric and digitally-enabled banks has launched ‘Digital Dansala’ powered by the DFCC Virtual Wallet to support local communities affected by the COVID-19 pandemic. The ‘Digital Dansala’ program comes to fruition at a time when the spirit of giving and sharing is growing in strengths amongst Sri Lankans, as we look for ways to support our brothers and sisters who are bearing the brunt of this adverse situation.

The ‘Digital Dansala’ by DFCC Bank is a first of its kind initiative by a bank in the island, whereby DFCC customers who use the Virtual Wallet will be able to make a cash donation of any value, towards the distribution of dry rations to the local communities across DFCC’s branch network who have been affected by the current situation in the country. DFCC Bank will match these donations collected through the ‘Digital Dansala’ that was generously supported by customers, which is in line with the Bank’s sustainability strategy towards building resilient communities. The distribution of the dry rations to those affected citizens will be centrally coordinated by the Sustainability Department of the Bank in liaison with the 139 branches network around the country.

Powering this initiative is the DFCC Virtual Wallet, which was also a first of its kind mobile virtual wallet product in the Sri Lankan banking industry when it launched in 2015.

The Virtual Wallet facilitates a plethora of convenient features such as over 40 billers, institutional payments, transfers via CEFT, ability to pay other bank credit cards, checking the balance of customer’s Current/Savings accounts, Interest rates, Fixed Deposit maturity dates, add beneficiaries to favorites and share CEFT payment advice via email or WhatsApp. Furthermore, customers can access a range of functions relating to the credit cards such as adding a DFCC credit card, checking balances, 3-month statements, transaction details, cashback reward details, minimum payment due, recent, and unbilled transactions and available balance.

Moreover, in line with the current situation, DFCC Bank has built on more than 25 new features to this channel over the past few months, adding value to existing and new customers. In order to support this initiative, DFCC customers can now access the ‘Donations’ option, in their Virtual Wallet app to make the donation. Initially, the users need to log in using their username and password, following which they click on the ‘Bills’ icon, and then the ‘Donations’ option. Then, the users can select the ‘Digital Dansala’ option and subsequently carry out their donation transaction. Any non-DFCC Bank customers can open an account via the Online Account opening option available on the website from the safety of their home and then activate the DFCC Virtual Wallet to donate funds using the debit card or calling the 24/7 hotline 2350000.

“We as a nation are collectively going through one of the toughest periods of our times as I recall. While our dedicated frontline workers are engaged in protecting the people from the health adversity, essential services such as financial institutions need to work towards offsetting the financial adversity people are facing.

In this regard, DFCC Bank believes it is important to go beyond the confines of the norms, and aptly integrate digital technology to assist during these challenging times. With the DFCC Virtual Wallet’s ‘Digital Dansala’, the human need to give and share is made accessible to our customers, whereby they are given an opportunity to play a role toward donating whatever they wish to assist those affected – the nation on its way towards recovery” Commenting on this initiative, DFC CEO Lakshman Silva said.