Sri Lanka’s insurance industry sees a decline in premiums in 1H2020 amidst Coronavirus crisis

2 min read

In reflecting a contracted growth of Sri Lanka’s insurance industry, the industry’s total premium declined by 2.79% in the first half of the year in respect of the corresponding first half of 2019, reaching Rs.16 billion, according to latest report by KPMG Sri Lanka.

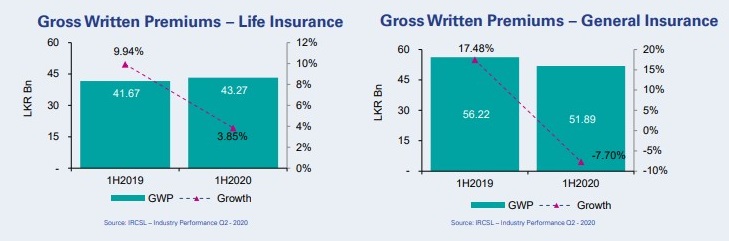

As accustomed, general insurance contributed the higher proportion of the industry’s premiums recorded at Rs 51.89 billion. Meanwhile, premiums for long term insurance stood at Rs 43.27 billion. The Life insurers grew their gross written premium by a mere 3.85% a significant decrease from the corresponding period’s 9.94% (1H2019).

The declining trend of written premiums during the first half of the year was in fact driven by the outbreak of the Coronavirus with many policyholders being unable to pay out monthly premiums due to lockdowns and economic uncertainties. Amidst such unprecedented times, there were reflections of a stand out performance by Softlogic Life Insurance PLC that recorded premium growth of 10.33% for the period.

On the non-life business side, gross written premium of General Insurers significantly reduced by 7.70% in contrast to the growth of 17.48% in the first half of 2019. A significant contributor to the gross written premium of the general insurance business was Motor Insurance which recorded Rs 30.78 billion Gross Written Premiums (GWP). Despite Motor Insurance being an important class of the general insurance sector, motor premiums decreased by 3.83% during the first half of 2020 compared to first half of 2019.

The outbreak of coronavirus severely impacted the travel and tourism industry since December 2019. This led to a significant proportion of hiring vehicles being unused for tourism purposes. The dip in the usage of hiring vehicles may have negatively affected the motor premiums of the general insurance industry. A significant decrease of 10.68% was noted in written premiums of health insurance during the first half of 2020 compared to the corresponding period of last year. Despite the increasing health concerns arising from the pandemic, the dominant unfavorable economic conditions were a barrier for health insurance premium growth. The contribution from health insurance premiums were recorded at Rs 8.40 billion.