Emerging market debt deluge forecast as U.S. election dust settles

2 min read

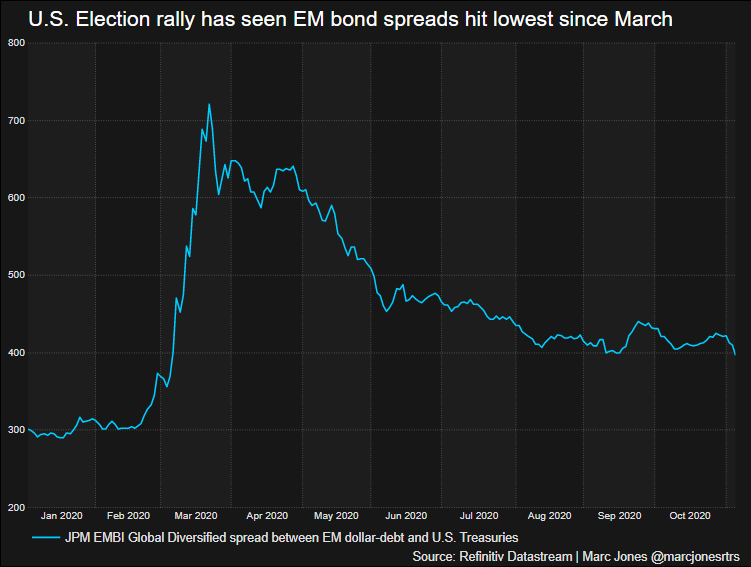

The surge in risk appetite among investors after this week’s U.S. Presidential election is likely to trigger an end-of-year borrowing rush by developing world governments, analysts say.

Emerging market (EM) bonds and currencies have surged as the unfolding U.S. elections have left Democrat Joe Biden edging closer to winning the White House.

The greenback has slumped to a two-month low, making emerging markets more attractive for non-dollar investors, while the prospect of Biden dialling down Donald Trump’s trade war with China is seen as another potential positive.

“Given the conducive market backdrop, we expect supply (debt issuance) to pick up in coming weeks,” analysts at Morgan Stanley said in a note on Friday, predicting $25 billion worth of sovereign issuance and another $5 billion worth of quasi-sovereign sales before the end of the year.

The rush comes as the coronavirus crisis leaves governments with substantial holes in their finances. Analysts had already expected overall EM issuance to meet or surpass the record $620 billion governments and companies sold in 2017.

“With this credit compression crashing lower, sovereigns must be tempted to come with a wall of issuance as next year is still going to be quite challenging,” Tim Ash at BlueBay Asset Management said.

Ash added this week’s rally had seen a surge of buying from yield-hunting “tourist” investors, those that don’t usually buy EM debt, helping even countries like Oman, which saw a turbulent debt sale last month, and Sri Lanka where default worries are growing.

A recent International Monetary Fund study showed the last decade saw the largest, fastest and most broad-based increase in debt in developing economies in the past 50 years.

Total EM debt has grown by 60 percentage points of GDP it calculated, while the Institute of International Finance estimated it rose another 10 points earlier this year to stand at a record 230% of overall EM GDP.

With many countries facing gaping budget deficits it is encouraging countries to leap on the lower borrowing costs.

“Clearly credit spreads have been tightening this week so it is cheaper (for emerging market borrowers) to come out and issue now,” said UBS’s head of EM strategy Manik Narain.

“But whether they do it now, or wait to Q1 next year” he said, referring to the U.S. Federal Reserve potenially pushing global rates lower with more easing, “I’m not quite sure.”

Source: Reuters