CBSL likely to hold policy rates steady to strengthen to strengthen key economic indicators

1 min read

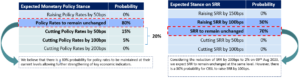

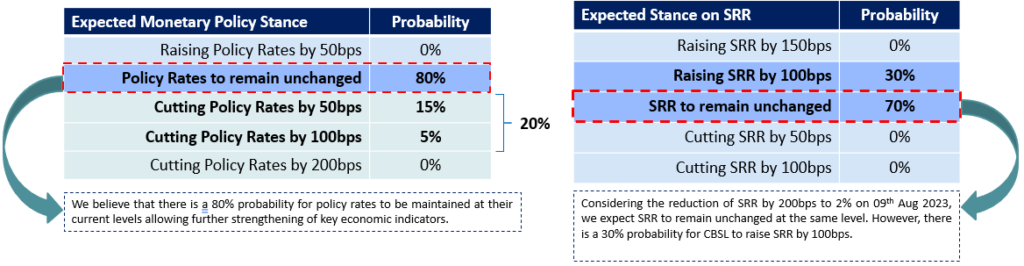

The Central Bank of Sri Lanka (CBSL) is likely to hold policy rates steady in the upcoming monetary policy review meeting scheduled for next week, according to a pre-policy analysis report by First Capital Research (FCR).

The report forecasted an 80% probability that policy rates will remain unchanged to strengthen key economic indicators. However, it predicted a 30% chance that the Statutory Reserve Ratio (SRR) might increase by 100bps, while policy rates have a 20% chance of being reduced.

As the CBSL is considering a shift towards a single policy interest rate mechanism to improve monetary policy transmission, FCR predicted a 50% chance of cutting the Standing Lending Facility Rate (SLFR) to adopt this new stance.

The report acknowledged positive economic trends such as private sector credit growth, market liquidity, and GDP growth, and suggested these indicators point towards a solid economic foundation.

Meanwhile, Sri Lankan Rupee is expected to fluctuate within a range of LKR 295.0-305.0 in the first half of 2024, with a slight depreciation expected in the second half. Inflation has been decelerating and is expected to pick up slightly due to seasonality