World Bank expects a sizeable deterioration in Sri Lankan banks asset quality

2 min read

With the phaseout of moratoriums and other relief measures, World Bank (WB) expects a sizeable deterioration in the asset quality of Sri Lanka’s banks which may eat into their capital resources.

“NPL ratios can shoot up as previously unclassified loans are reclassified as NPLs and some loans under repayment moratoriums and restructuring become non-payment. As a result, banks will be required to increase loan-loss provisioning to absorb the losses on the delinquent loans,” WB stated in its South Asia Economic Focus Report (Spring Edition).

Since most moratoriums just expired at end-March this year, the WB expects more time to materialize a deterioration of asset quality in the banking sector. As of September 2021, about 10 percent of gross loans were still under moratorium and 6 percent under restructuring, which are sizable numbers compared to the country’s NPL ratio, which hovers around 4 to 5.5 percent since the pandemic.

Some experts fear that the moratorium and restructuring programs have delayed recognition of NPLs as banks stopped classifying delinquent loans that are under deferment, restructuring or rescheduling, as “non-performing”. Further, the WB said that such programs may have also created a lack of transparency about the health of bank balance sheets.

In the event of a surge in defaults of existing loans, the WB banks noted that Banks may have to replenish capital to ensure that they have enough for a full recognition of credit losses, which can be a drag on capital resources.

“The impact can be especially severe for banks with low profitability and thin capital buffers and in countries or sectors with slower,” it alerted.

In case of all remaining loans in the program become delinquent, WB warned that the country’s banking sector could see an 11.9-percentage drop in its capital adequacy ratios as a result, leading to a sizeable reduction in the asset quality.

According to Bloomberg, Sri Lanka’s one-year default probability reached 27.9 percent as of July 2021, the highest in Asia, up from around 13 percent in January 2021.

Further, Banks’ holdings of government securities also expose the financial sector to sovereign risks.

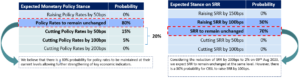

WIth relief measures and easy-liquidity conditions backed by loose monetary policy and expansive fiscal policy coming to an end, Sri Lanka’s financial sectors is expected to see higher impaired loans and credit costs. The Central Bank of Sri Lanka (CBSL) granted an a100-basis point policy rate hike in March and a more recent 700-basis point rate hike on April 8 to curb inflation-raised interest rates and borrowing costs.

Amidst this challenging environment, WB urged the Policymakers to re-orient policy to strengthen the resilience of banking systems.